What Happens to My Bank Account When Filing Bankruptcy? - An Overview

When you file for Chapter thirteen bankruptcy, you are able to continue on using your existing bank accounts. Closing or Altering your bank account isn't required as part of the bankruptcy process. Your bank account will frequently stay unaffected by the filing, letting you to manage your every day funds as regular.

Civil Litigation and Landlord-Tenant Disputes in Woodbridge: Whether you are a company operator involved with professional transactions, a homeowner searching for improvement on the house, or someone consumer, you depend upon quite a few contracts for the sale or purchase of goods and solutions. That’s why you need to have certainty in the legal obligations you kind, and entry to significant-quality lawful counsel when disputes crop up regarding things such as breach of agreement promises, breach of warranty claims, enterprise formation for large and small organizations, partnership disputes, and dissolutions, credit score fraud statements, defamation promises, plus much more.

House loan calculatorDown payment calculatorHow Considerably household can I manage calculatorClosing charges calculatorCost of residing calculatorMortgage amortization calculatorRefinance calculator

He’s the continual-handed counselor to recommend you thru Among the most challenging intervals in your lifetime. And, if you do ought to file suit, he is definitely the tenacious courtroom bulldog who will convey household the acquire. John’s colleagues agree he may be the go-to individual for workers. Depending on surveys of...

How to avoid this issue. In case you owe cash to the bank, open a completely new account elsewhere before you decide to file for Chapter seven. You'll have a greater chance of emerging from bankruptcy by having an Lively bank account. Just make sure to continue to keep it in excellent standing thereafter.

Through the method, the court will assign you a trustee. A trustee is often a neutral 3rd party Learn More Here who will evaluate your situation, obtain your repayment and deliver it to your creditors in your behalf.

You’ll also should live under your implies — Chapter 13 requires you to put disposable revenue toward your debt. And it'll affect your capability to borrow money For several years.

Understand that though prebankruptcy preparing will visit our website help, The easiest method to keep away from unforeseen difficulties is to refer to by using a educated bankruptcy attorney prior to filing your Chapter 7 case.

When you file, the court docket will demand you a $235 situation filing cost and a $75 miscellaneous cost. If desired, you might be next able to shell out the fees in installments.

Stage 2- Examine Possibilities – Your attorney will evaluate what variety of bankruptcy is suitable. There's two sections advice on the federal bankruptcy code, Chapter seven and Chapter 13, that are used for filing own bankruptcy dependant upon the person situations. A Chapter seven bankruptcy, at times generally known as straight bankruptcy, entails the sale of non-secured belongings to pay back as much personal debt as you possibly can and lets a debtor to have most debts dismissed which include credit card financial debt and professional medical payments. It is out there for individuals who do not need regular profits to pay for their obligations.

Often identified as a “clean get started” bankruptcy, a “clean slate” bankruptcy or possibly a “liquidation,” Chapter seven bankruptcy is The ultimate way to take control of your financial scenario and start above by removing your debts. In Chapter 7 you are going to wipe out your bank card debts, health care Read Full Report charges, payday loans, lawsuits, judgments, unpaid balances on repossessions or foreclosures, private loans, guarantees and much more.

Nonetheless bankruptcy is filed by customers hundreds of Many periods annually. Here’s a action-by-phase procedure for people enthusiastic about filing Chapter seven or Chapter 13 bankruptcy.

Move one – Obtain Files – Gather your financial documents to ensure that you and your attorney can evaluation your debts along with your Total fiscal overall health and examine no matter if a bankruptcy filing is acceptable. This is certainly step one in the method.

You will have to carry evidence that you choose to submitted your tax returns for the final four a long time and almost every other data your trustee asks for.

Brian Bonsall Then & Now!

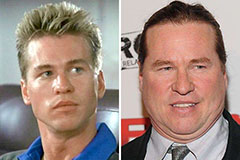

Brian Bonsall Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!